Peru: Blueberry, avocado, and cocoa exporters lead the first half of 2025

Since the 1990s, the Peruvian government has promoted the economy through promotional laws and treaties to achieve Peru's integration with the world, requiring companies to compete internationally if they wish to exist and grow. Given this situation, the agro-export sector has regained a foothold in the country, experiencing significant growth over the past twenty years.

Agro-exporting companies have played a fundamental role in the development and consolidation of the sector, receiving a basket based on traditional products such as cotton and sugar and innovating with emblematic products such as grapes, blueberries, and avocados, among others, significantly contributing to positioning the country as one of the leading agricultural suppliers worldwide. With this, they reached 8th place globally in fresh fruit by 2024, up from 2001th place in 50.

Agricultural exporters have managed to open markets in key destinations such as the United States, Europe, China, and other Asian countries. They are now beginning to establish international strategic alliances, import high-yield genetic material, implement cutting-edge technologies, and make sustained investments in infrastructure, research, and development.

Currently, many of the leading companies in the sector have established themselves thanks to the success of their flagship products, generating a multiplier effect that has attracted domestic and foreign capital interested in entering and scaling up in this competitive market. According to figures from PromPerú and SUNAT, more than 2,590 companies export agricultural products annually, and new companies join each year, expanding the exportable offering and diversifying commercial destinations.

The increase in the number of formal businesses helps build long-term relationships, both with international clients and with local producers, and the development of an entire supply chain. Of the 4.8 million people working in the agricultural sector, agro-exports generate formal employment for nearly 800. In other words, the agro-export sector accounts for one in six workers, and if it continues its trend of doubling its size every eight years, in less than twenty years, half of the agricultural sector's workers will be formally employed in the agro-export sector.

MACHU PICCHU, CUSTOMIZED CACAO, SUSTAINABLY DEVELOPING CACAO-PRODUCING COMMUNITIES

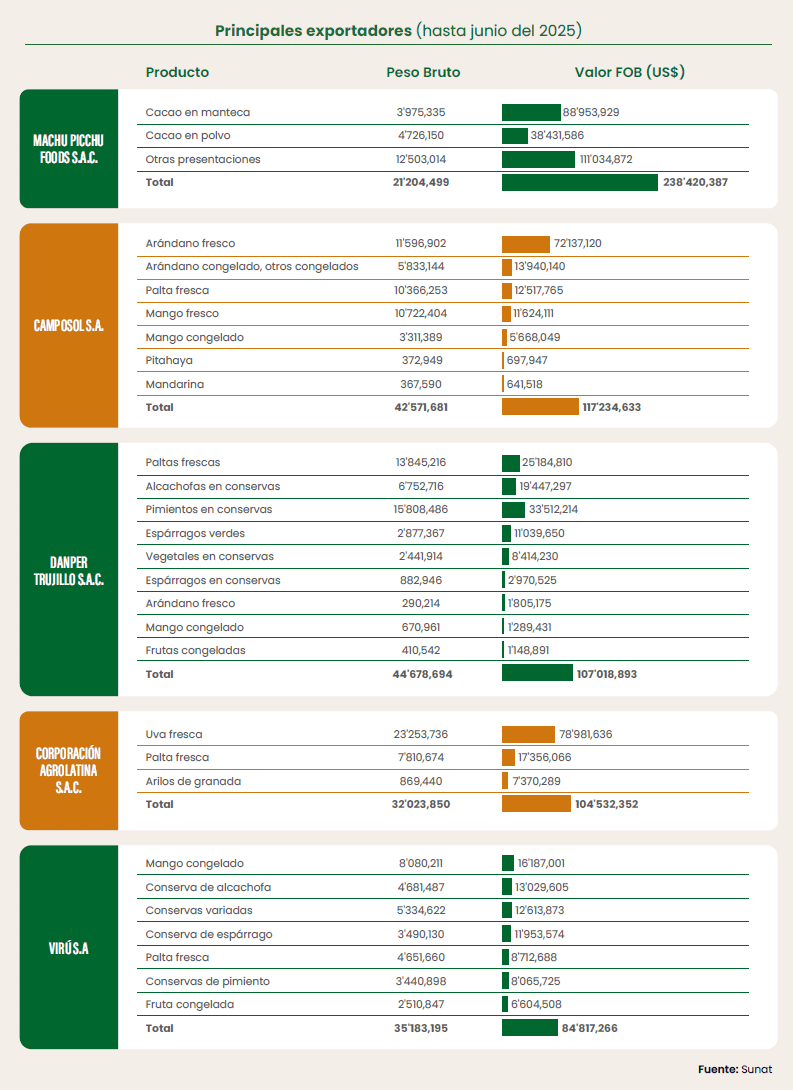

During the first half of 2025, the leading company in Peruvian agricultural exports is Machu Picchu Foods SAC, with shipments valued at nearly US$238 million. However, given the high product diversification and the large number of companies in the Peruvian agricultural export market, this figure only accounts for around 4% of Peruvian agricultural exports.

The company specializes primarily in cocoa and its derivatives, with cocoa butter (37%) and cocoa powder (16%) among its main exports. Its main destinations are the United States (28%), Chile (17%), and Argentina (14%).

Machu Picchu Foods' strength lies in its extensive supply network, according to its 2023 sustainability report. It also collaborates with more than 15 family farms spread across 32 collection centers in seven regions: Cajamarca, San Martín, Huánuco, Junín, Ayacucho, Cusco, and Madre de Dios, enabling it to ensure quality cacao, which is processed at its plant in Callao and then directed toward final confectionery products. It also operates two plants in Pisco, specializing in derivatives such as cocoa powder, butter, and liquor.

CAMPOSOL, PRODUCING THE BEST FOOD TO SERVE ALL THE FAMILIES IN THE WORLD

In second place during the first half of the year, but with prospects of becoming the largest exporter this year, is Camposol SA, thanks to its diversified portfolio (blueberry, cherry, asparagus, mandarin, mango, avocado, pitahaya and grapes) that exports directly to clients throughout North, Central and South America, Europe, Asia and Oceania.

Its leading product is blueberries, which reached US$85 million so far in the 2024/2025 campaign, representing almost 70% of its sales. This is followed by avocados, currently in full swing, with 10,366 tons exported for a value of US$13 million; mangoes, with an atypical campaign due to its production rebound, with 10,722 tons and US$12 million; dragon fruit, which has had a booming year with 373 tons and US$698; and mandarins, with 368 tons and US$642. The performance of its grape campaigns and the close of the blueberry season, traditionally very strong, are still awaited.

Regarding blueberries, Camposol leads the domestic market, with primary destinations in the United States (53%), Europe (31%), and China (9%). Regarding avocados, it also competes among the leading companies, reaching Europe (40%) and the United States (32%), a performance in line with the industry average. The company also maintains similar positions in products such as grapes and mangoes, where it does not lead but actively participates.

Camposol operates primarily with its own crops on Peru's northern coast. Its leadership in blueberries has spurred a wave of investment and agricultural innovation. Recently, it has been notable for its first massive shipments of pitahaya, which could open up a new line of high-value products. Furthermore, there is evident interest in expanding into Asian markets, leveraging the opening of the new port of Chancay and using both its flagship product and pitahaya as gateways.

DANPER, NOURISHING THE WORLD SUSTAINABLY WITH HEALTHY FOOD

Rounding out the agricultural export podium is Danper Trujillo, with nearly US$107 million exported thanks to a diversified portfolio. Avocado, with 13,845 tons valued at US$25 million, is the main product; however, by year's end, blueberries will be its leading product. Additionally, they offer artichokes, asparagus, piquillo peppers, mangoes, grapes, and gourmet products under their Casa Verde line, focused on niche consumers and premium markets.

Danper has its own production and storage facilities, which allows it to maintain a constant supply, flexibly adapt to campaigns and market fluctuations, and improve its responsiveness to changes in international demand. The company was a pioneer in the export of fresh asparagus to China and is currently expanding into new markets in Asia with high-value fruits such as blueberries and more sophisticated processed products.

GIANTS IN CALISTHENICS FOR THE SECOND SEMESTER

The second half of the year will bring other exporters that have not been particularly prominent until now, as their main products' campaigns reach their best production levels since July: Virú SA and Complejo Agroindustrial Beta.

Virú SA operates the entire chain from planting to export. Avocado is its main source of income, accounting for nearly 40% of its annual turnover. It also offers artichokes (17%), piquillo peppers (11%), and asparagus (9%).

One of its strengths is its production on more than 15,000 hectares of owned and leased land, and its partnership with products from small and medium-sized farmers. This strategy provides a high degree of operational versatility, allowing it to maintain supply continuity and adapt its production capacity to global market demands.

In addition to its agricultural production, Virú has developed a line of value-added products, including ready-to-eat products made with quinoa, sauces, creams, and fruit pulps such as açaí, geared toward meeting healthy consumption trends. It exports to more than 50 countries on five continents, with a significant presence in the United States, Europe, and Asia. It also has sales offices in Spain, Italy, France, and the United States, strengthening its international expansion model.

Another giant in Peruvian agro-exports is Complejo Agroindustrial Beta. Approximately 59% of its revenue comes from blueberries, consistently ranking it among the top five exporters of this fruit nationwide and, in terms of volume and value, also among the largest in the Peruvian agro-export sector overall. Table grapes, its second strategic product, represent nearly 30% of its turnover. It also sells asparagus and avocado, each accounting for nearly 5%.

Beta doesn't have a particularly visible presence in the first half of the year because its revenue depends on blueberry and grape harvests, whose peak harvests and exports are concentrated between August and December. This explains its low level of presence in the first half of the year, but it also anticipates a strong rebound in the second half, when its volumes and revenues reach significant levels.

The company maintains a high level of control over its entire operation. It has its own agricultural estates (in regions such as Ica, Lambayeque, and Piura); a network of specialized packing plants for each crop; and sales offices in Spain, the Netherlands, the United Kingdom, and the United States to improve marketing.

The remarkable performance of the Peruvian agricultural export sector is due to the leadership and strategic vision of its companies, which transform challenges into opportunities and have managed to turn the country into a global benchmark. They compete globally and lead in export volume and value; they set the pace in innovation, sustainability, and the opening of new markets; they integrate technology, strengthen supply chains, and adapt to the demands of international clients and authorities. Maintaining this path and making improvements will be key in the coming years, especially in a context of increasing global competition, climate change, and logistical transformation. The future of Peruvian agriculture will largely depend on how these companies continue to evolve, protecting their leadership, and generating value throughout the entire export chain. Peru has entrusted them with competing in the global market, and they have made the country a global expert in agricultural production, poised to enter the top five agricultural exporting countries in the world.